British American Tobacco: The bargain giant that poses a moral dilemma for investors.

This historically low-risk FTSE 100 stock has lost almost 50% of its share price in 2018. It is currently trading at 2.15 times earnings with a mouth-watering 7.16% dividend yield. The downturn started after news that e-cigarette sales are on the decline in the Asian market, and was compounded by the American Food & Drug Administration's plans to ban the sale of menthol cigarettes in the US. Menthol cigarettes make up a quarter of British American Tobacco’s (ticker: BATS) profits so this would be a major blow if a ban were to materialise.

Despite the bad news, the company is in much stronger shape financially than its share price reflects; it has global market diversification with several income streams, strong branding and adaptable management. With the company’s price to book ratio hovering around 1, this appears to be a stock Ben Graham himself would have piled into.

*A company trading a price to earnings ratio of 2 and a price to book ratio of 1 can be compared to a vending machine: this vending machine's individual parts are worth £20, in addition, it spits out a £10 note every year. Would you buy that machine for £20 ?

The trouble for a moral investor is that BATS is plagued with a history of questionable practices; blatant advertising of cigarettes to children in Africa, illegal lobbying in the EU, bribery of African officials to delay anti-smoking research, purposeful targeting of unstable and impoverished nations, and a class action lawsuit to the tune of a few billion dollars in Canada.

This poses two problems in the mind of the investor: firstly, do we really want to be putting money towards advertising campaigns aimed at increasing the numbers of children smoking in impoverished or war-torn countries? Secondly, as a long-term investor in this age of information and openness, can a company that relies on an unhealthy product really expect to perform well over the next 20-30 years?

If we look at another company, Diageo - the world’s largest distiller of premium alcoholic beverages - we see the market has a much more optimistic outlook. The manufacturer of Smirnoff, Guiness, Bailey’s and Johnny Walker to name a few, is currently trading at over 26 times earnings. The market sentiment for Diageo is that it will be a successful business for years to come; it is a similarly international company with a very wide economic moat and clever management that has tailored its products to consumer demand. There is no doubting that Diageo is a good business, but the point is that they too rely on a product that is inherently bad for you and it does not seem to be having an impact on their share price. So maybe it is not the carcinogenic properties of the product, but the demand that is depressing BATS's share price?

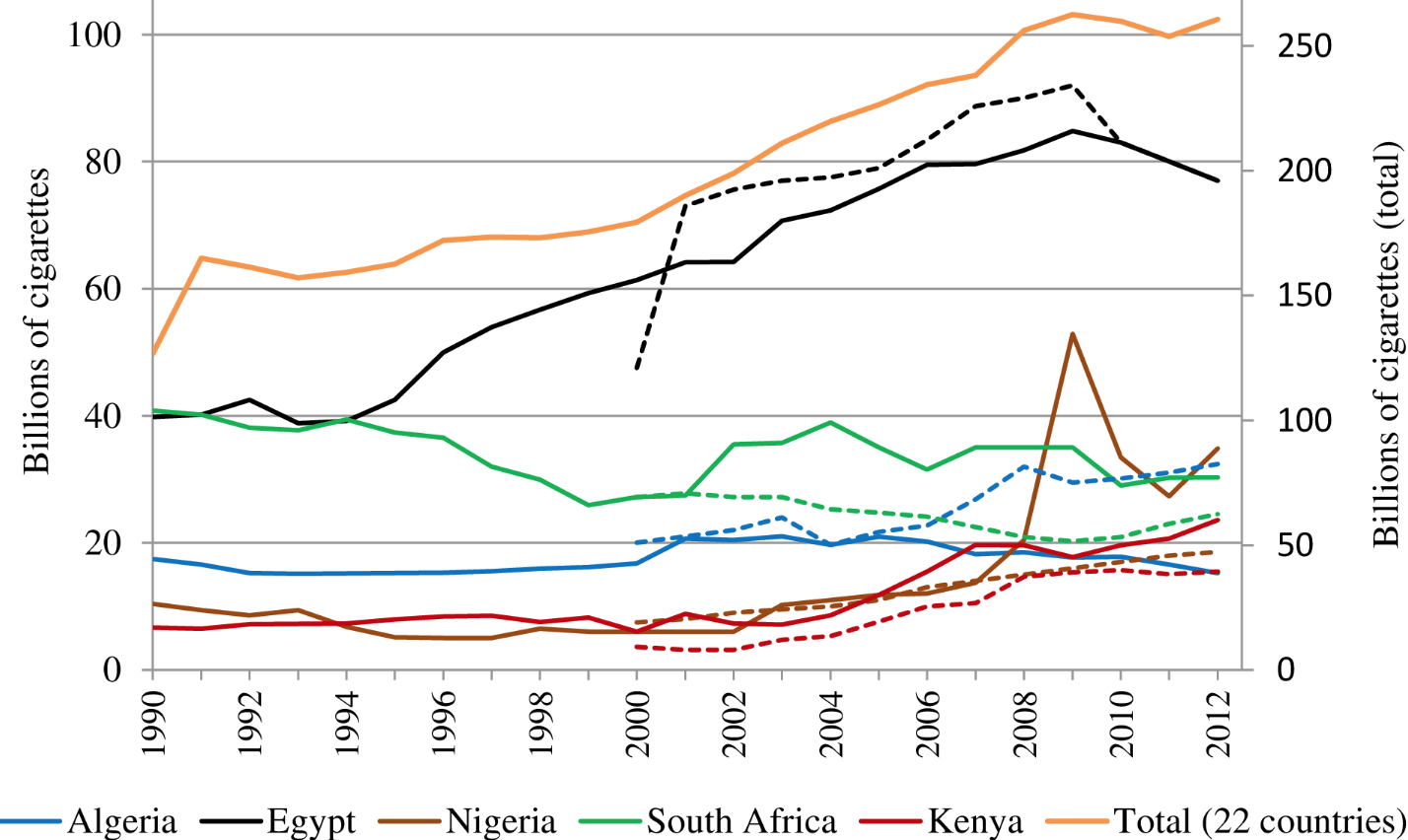

''The demand for cigarettes is surely decreasing!'' I hear you say. The world has known about the link between cigarettes and lung cancer for 70 years and has certainly reduced smoking levels in the UK and US, which now stand at about 17%. However studies show that the demand in Asia and Africa is still increasing year on year, and BATS has a very ‘healthy’ market share in both.

Source: https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0202467

Honestly, the notion that large company’s share prices will

be affected by their ethics is probably naïve. Despite some of BATS’s more

nefarious tactics, its plunge in share price is all about business and its

subsequent increase will also be dependant on profits, not principals. I do

believe any investor morally and financially willing to take a bet on BATS will

profit from it in the long term.

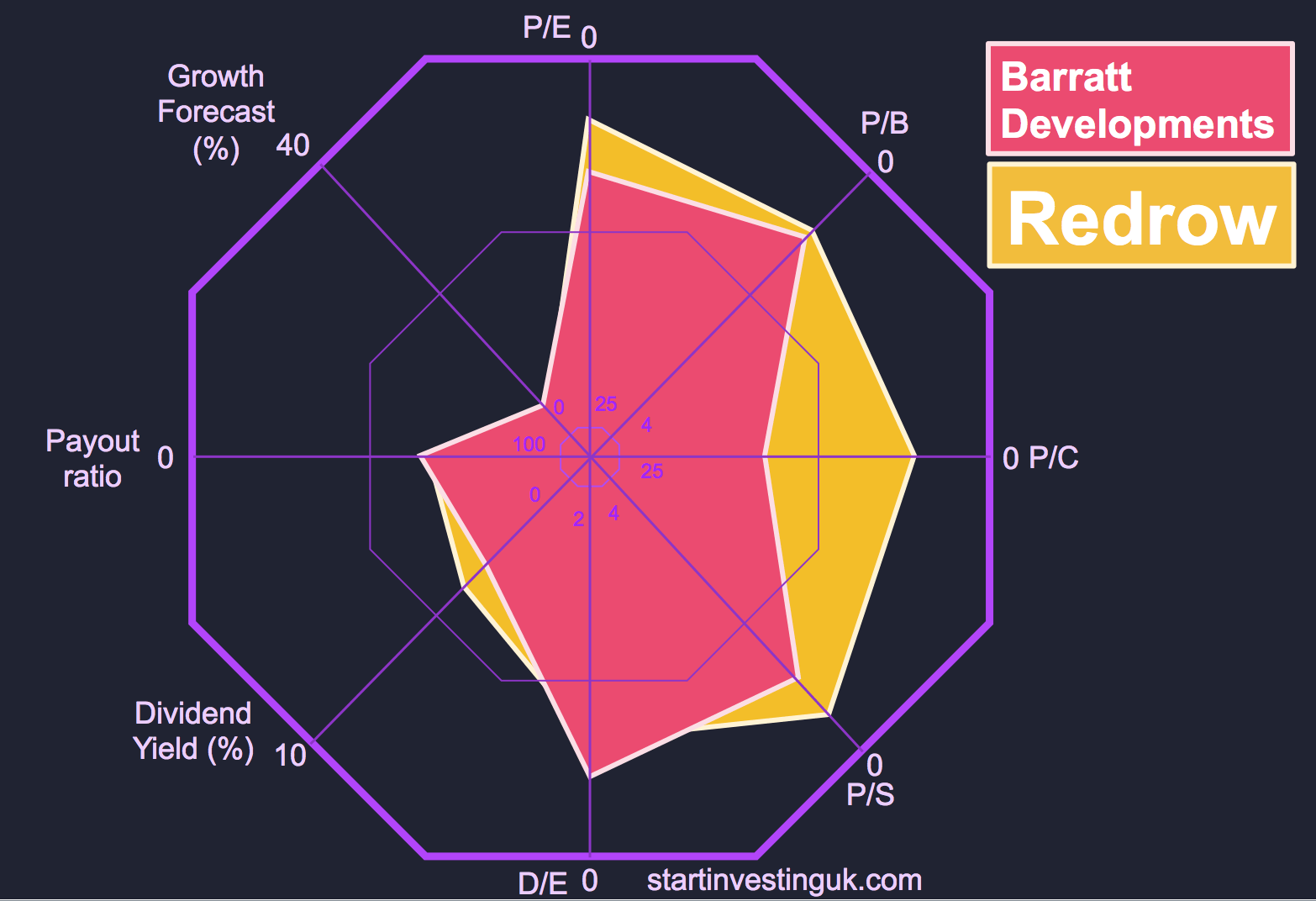

Fortunately for my moral compass, BATS missed out on making it into our Inherent Value Index this month due to a high Price/Cash ratio, currently standing at around 70. Also, unforgivably, their dividend was cut in December 2017 from £1.74 to £1.01. When times are tough and they certainly could be if the FDA's ban on menthol cigarettes goes through, you want to know your precious dividend payments aren’t going to be sacrificed. We always look for a rock steady history of consistent or increasing dividend payments for our stock picks.

Make no mistake though, BATS is a bonafide blue chip stock; a company that has been around for over 100 years, survived recession, lawsuits, several market crashes and the revelation that their product kills people. If it had made it onto our screen this month, would we be able to resist choosing this giant as our monthly pick? Lets just say that the high P/C ratio has saved us some controversy in the Start Investing house this month.

There are plenty of great companies out there trading at a discount to their intrinsic values and with most of them we don't have to consider whether investing in them makes us bad people. We have been screening and researching this week to find the best value company for our real money portfolio in December, and we have found a few excellent companies. If you would like to receive our monthly stock pick please subscribe to our mailing list here. We send out our pick via email on the first day of every month, remember you must subscribe before the 1st December to receive this month’s pick!

Thanks for reading, I would love to know if morality enters into your investing strategy, please leave a comment below if you have had a similar dilemma!

Joe