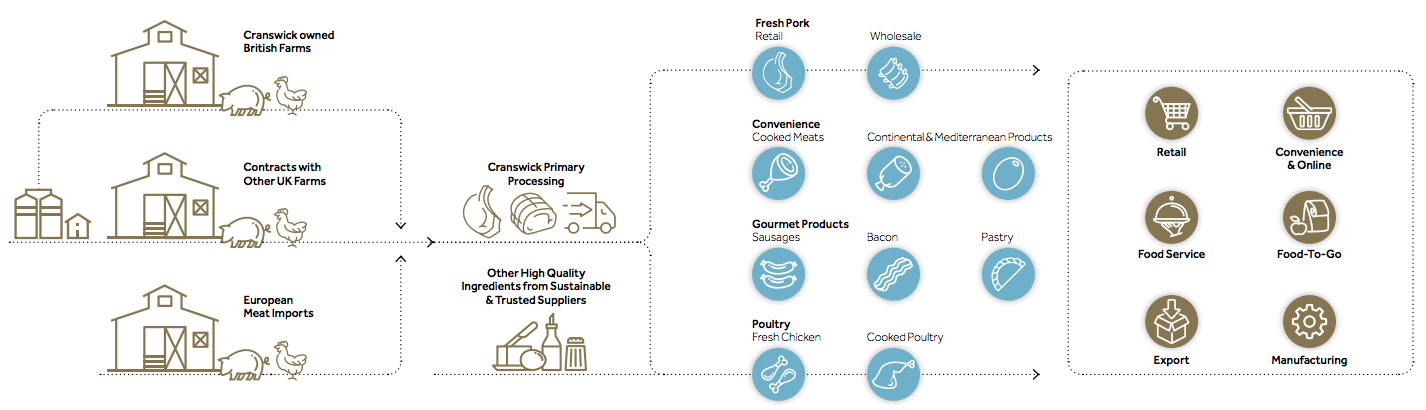

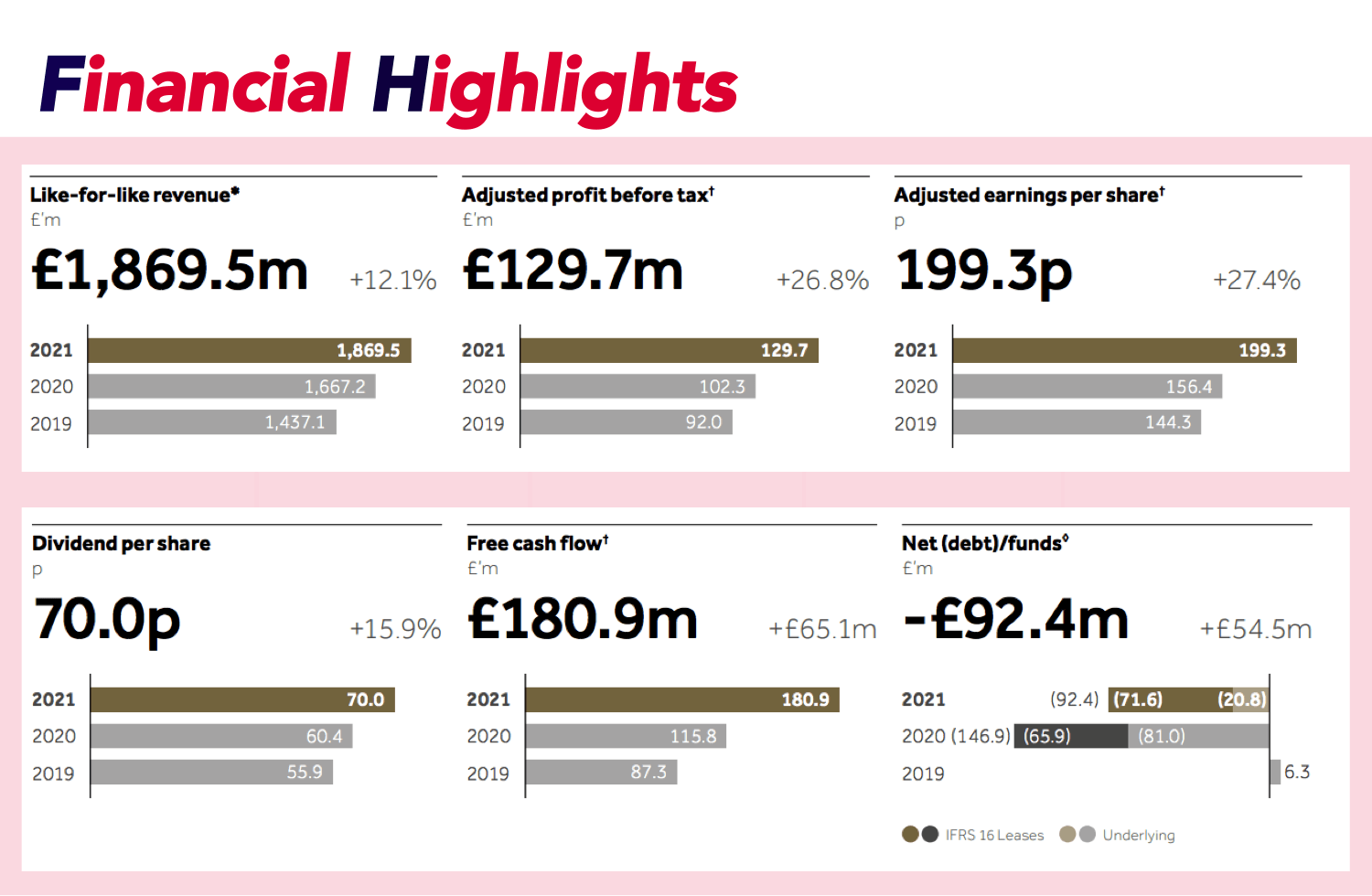

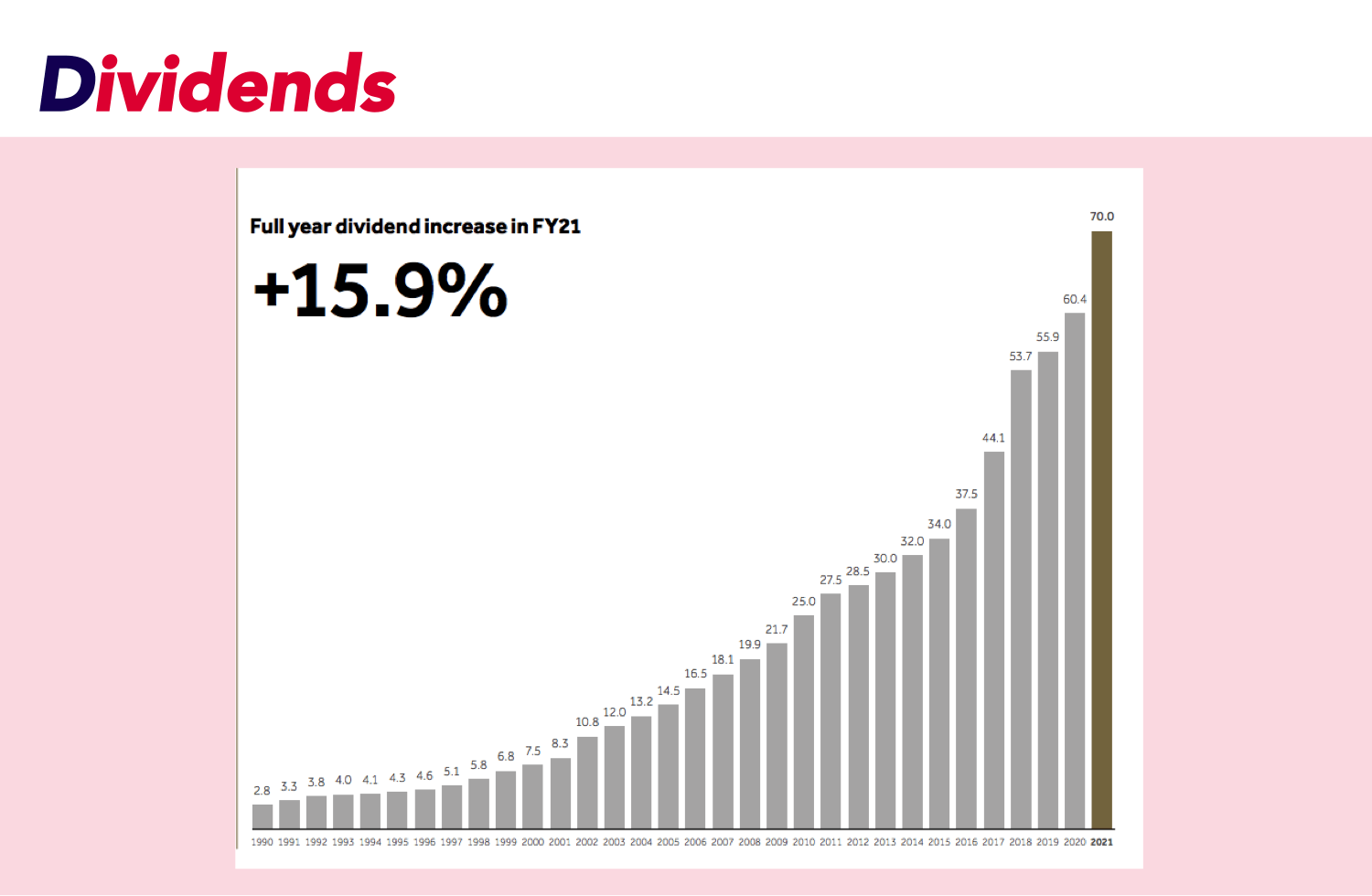

Simple enough. Additionally, Cranswick likes to farm it's own animals where possible with a focus on high welfare standards, sustainability and higher-end, great tasting products. From a financial standpoint, Cranswisk had a

very positive

annual report this year and has followed up with a

strong

set of results for the first quarter of 2021, up to 26th June:

To quote from the

interim report:

"Revenue in the 13 weeks to 26 June 2021 was

9.6% ahead of the same period last year, with corresponding volumes up

7.7% reflecting strong retail demand and increased sales from the poultry facility. Revenue growth also reflected the gradual but sustained recovery of the food-to-go and food service channel.

The UK pig price increased by

12% during the period; the average price across the quarter to June 2021 was

9% below that in the equivalent period a year earlier."

On Outlook:

"The outlook for the current financial year remains

in line with the Board’s expectations.The Board is confident that continued focus on the strengths of the Company, which include its longstanding customer relationships, breadth and quality of products, robust financial position and industry leading asset infrastructure, will support the further successful development of the Group during the current year and over the longer term."

So, no

red flags there.

A red flag does exist though; this big ol'

drop in share price:

The reason behind a

17% decrease in share price in a month is usually easy to find; often it is because of

bad news reported by the media or a profit warning.

Here though, we couldn't find any bad news in the media or from Cranswick themselves. Some digging around revealed a couple of

issues

with the wider market.

Firstly, the price of pork has

declined from

£165/kg in August to

£153/kg (-7.3%) this month which could certainly impact Cranswick's bottom line.

The second potential issue is a slowdown of

pork imports from

China; according to

PigWorld (The Voice of The British Pig Industry), exports of EU pig meat to China have been

falling in recent months, pushing the market further into oversupply, and putting further pressure on prices. In recent times, China has been importing massive amounts of pork from the EU due to

health problems with their own pig herds. Over the last couple of months though, it appears that the Chinese herds have somewhat

recovered and Chinese demand is now

falling.

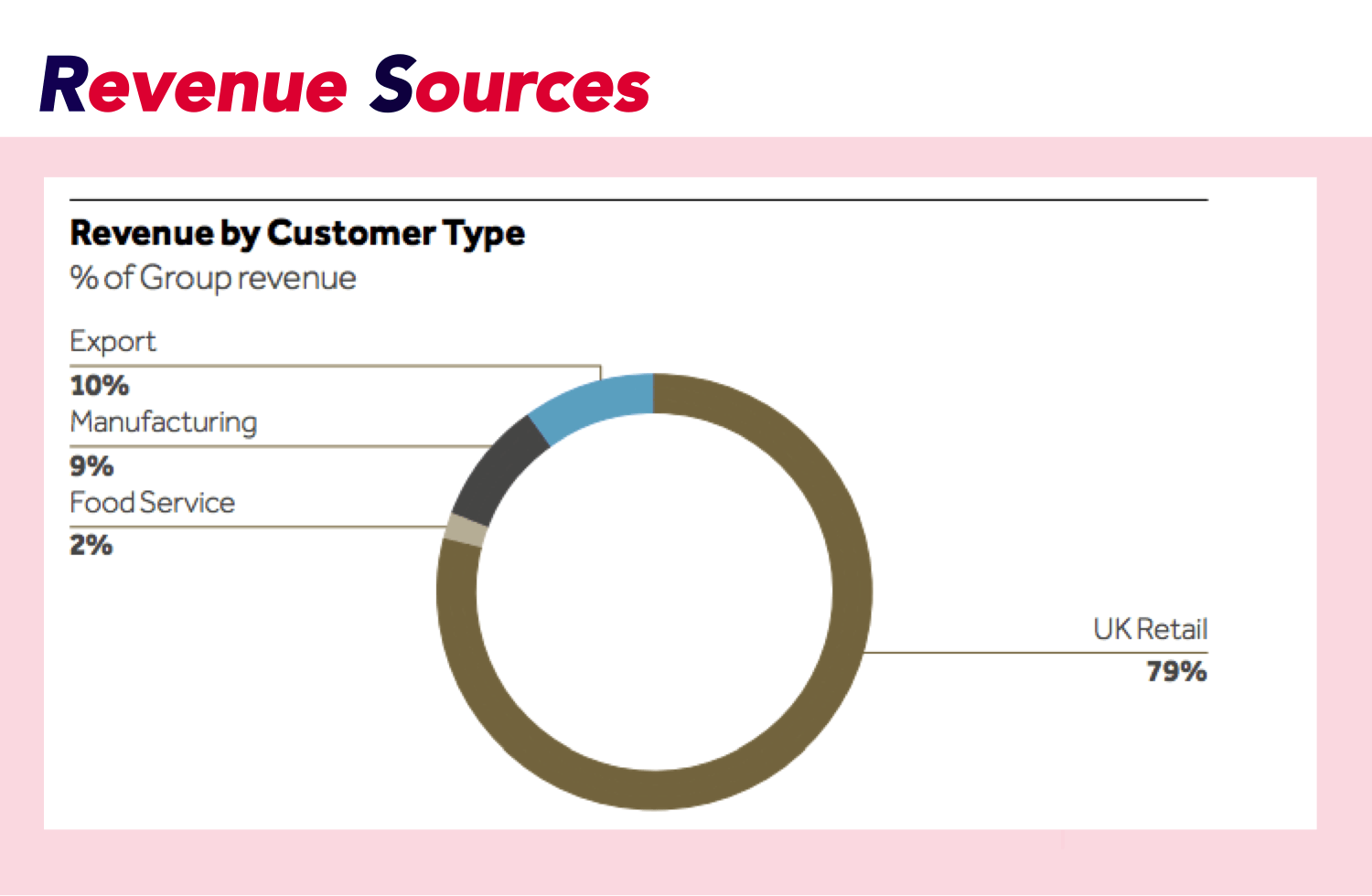

In another dramatic twist, we don't actually see this as too much of a

problem for

Cranswick. Please see the below:

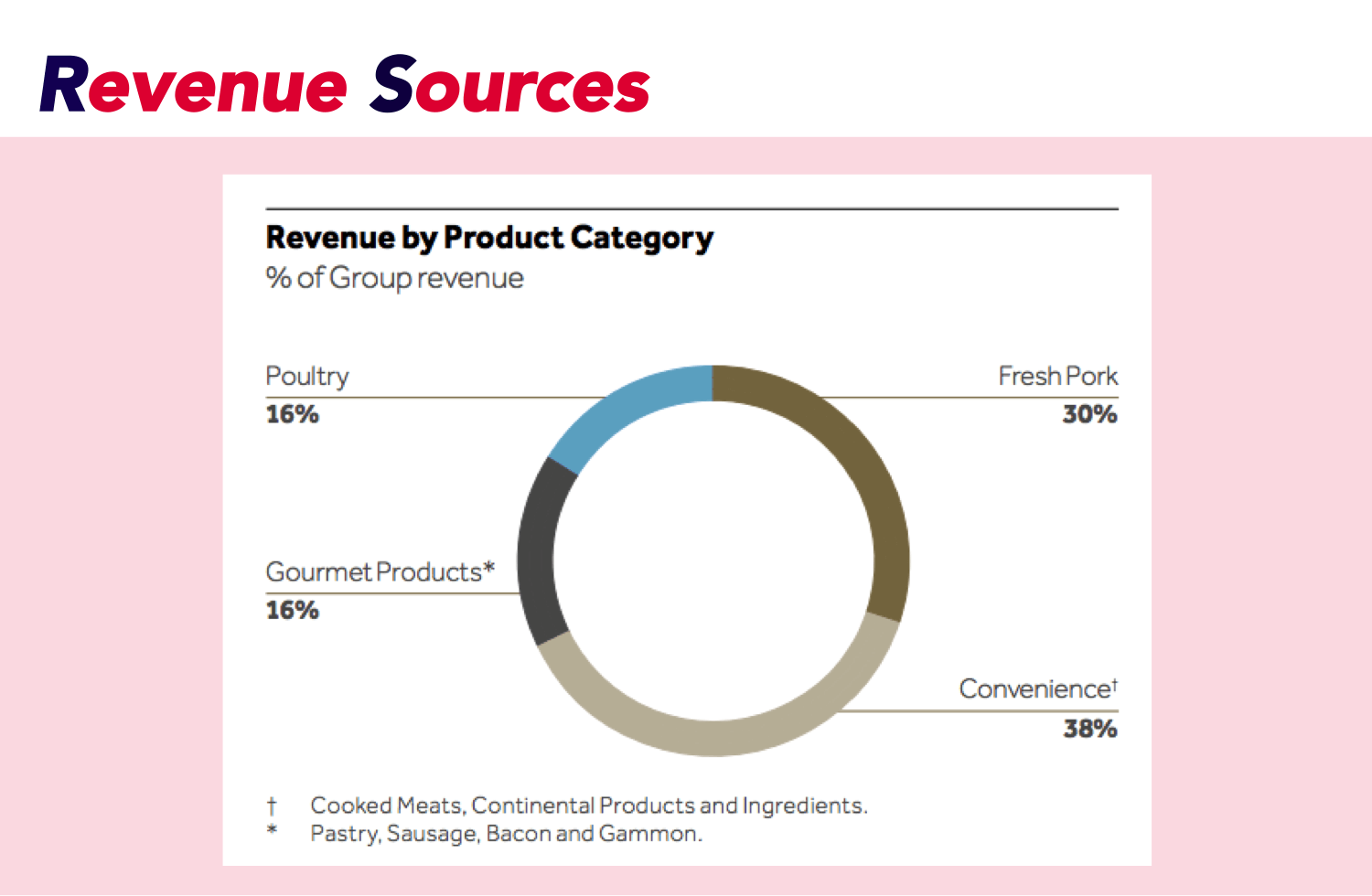

Firstly, the price of pork has declined from £165/kg in August to £153/kg (-7.3%) this month which could certainly impact Cranswick's bottom line.