With a likely

recession on the horizon in the UK, gold, silver and other precious metals are looking more

attractive as an investment, as their prices are generally uncorrelated to other assets.

Gold has historically held its

value throughout the ages. So when other investments

fall in value, gold is often seen as a

safe-haven investment. It is fair to say that in times of recession and depression, the price of gold usually rises - as demand is driven up by investors keen to

diversify their portfolios and spread their risk.

Pan African Resources is a mid-tier African-focused gold miner, who own and operate a portfolio of high-quality, low-cost operations and projects in South Africa.

Pan African have successfully grown their

profitable precious metal production in recent years via organic and acquisitive growth. We particularly like them because they focus on

high-quality sites that yield high margins with a relatively

low cost base. At the moment, PAF is one of the lowest cash cost producers of gold and PGM’s in Africa.

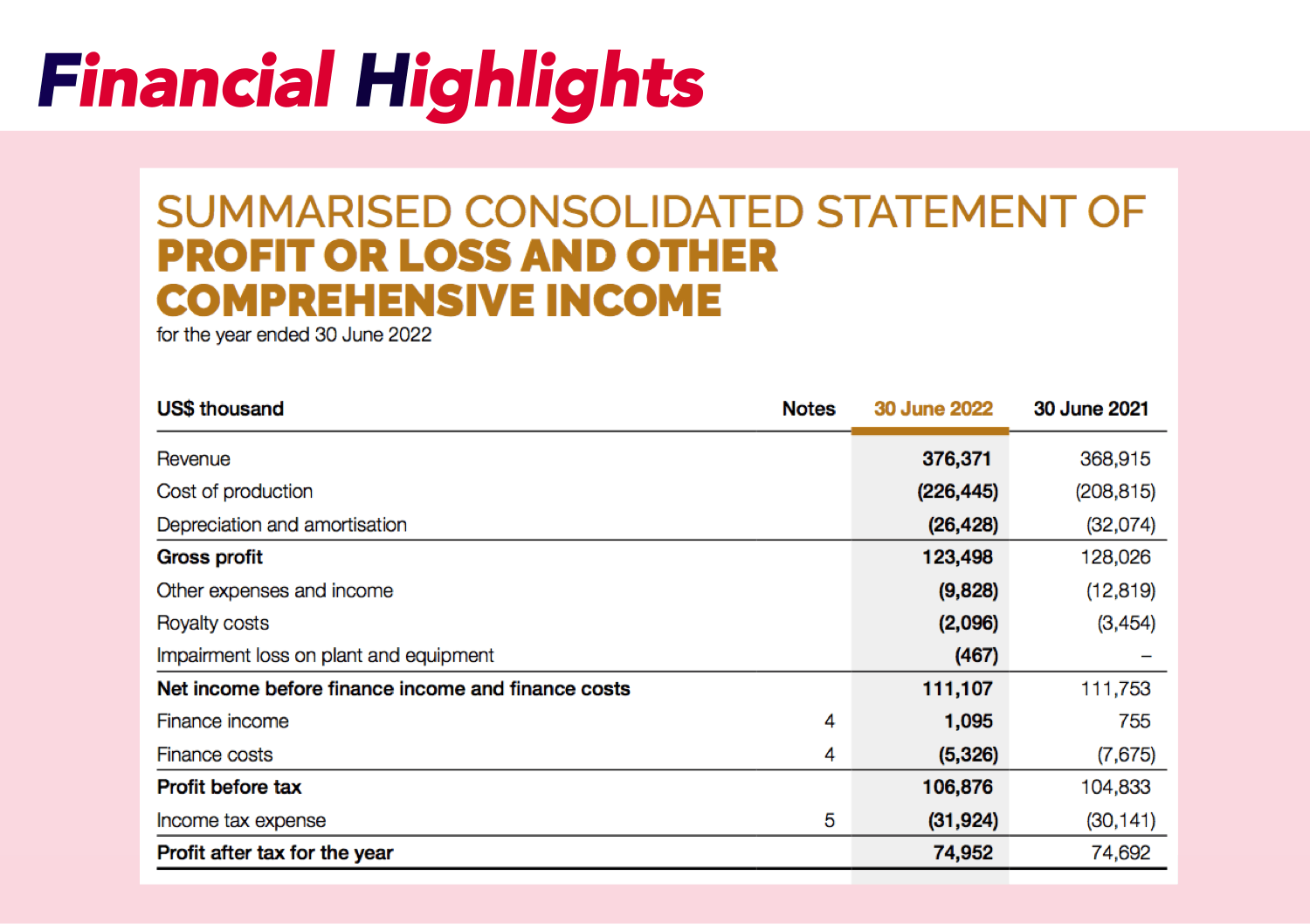

In September 2022, Pan African Resources PLC released it's financials for the year to the 30th June. They achieved

record

annual gold production as the company made progress on growth projects. Overall, the financial results were

encouraging:

- Pretax profit rose by 1.9% to

$106.8 million

from

$104.8 million

in the prior year.

- Revenue was up 2.0% to

$376.4 million

from

$368.9 million

on the back of record production.

- Gold output rose slightly to

205,688

ounces from

201,777

ounces, exceeding the group's own revised production guidance of 200,000 ounces.

- All-in sustaining costs inched up to

$1,284

an ounce from

$1,261

an ounce.

- Declared a final dividend of about 1.04 US cents, or

91p

per share (5.1%).

- Earnings per share increased to

3.90

US cents from

3.87

cents, while headline earnings per share improved to

3.93

cents from

3.87

cents.

The company also commented:

‘Over the past year the group has again made meaningful progress with our operational performance and growth projects. The organic growth projects at the Evander Mines' underground operations are on schedule to commence delivering within their anticipated production timeframes.'

Looking ahead, the company said it expects its production for the 2023 financial year to be

in line

with production achieved in the 2022 financial year, with more room for

growth

on the horizon.

In September 2022, Pan African Resources PLC released it's financials for the year to the 30th June. They achieved

record

annual gold production as the company made progress on growth projects. Overall, the financial results were

encouraging:

- Pretax profit rose by 1.9% to $106.8 million from $104.8 million in the prior year.

- Revenue was up 2.0% to $376.4 million from $368.9 million on the back of record production.

- Gold output rose slightly to 205,688 ounces from 201,777 ounces, exceeding the group's own revised production guidance of 200,000 ounces.

- All-in sustaining costs inched up to $1,284 an ounce from $1,261 an ounce.

- Declared a final dividend of about 1.04 US cents, or 91p per share (5.1%).

- Earnings per share increased to 3.90 US cents from 3.87 cents, while headline earnings per share improved to 3.93 cents from 3.87 cents.

The company also commented:

‘Over the past year the group has again made meaningful progress with our operational performance and growth projects. The organic growth projects at the Evander Mines' underground operations are on schedule to commence delivering within their anticipated production timeframes.'

Looking ahead, the company said it expects its production for the 2023 financial year to be

in line

with production achieved in the 2022 financial year, with more room for

growth

on the horizon.

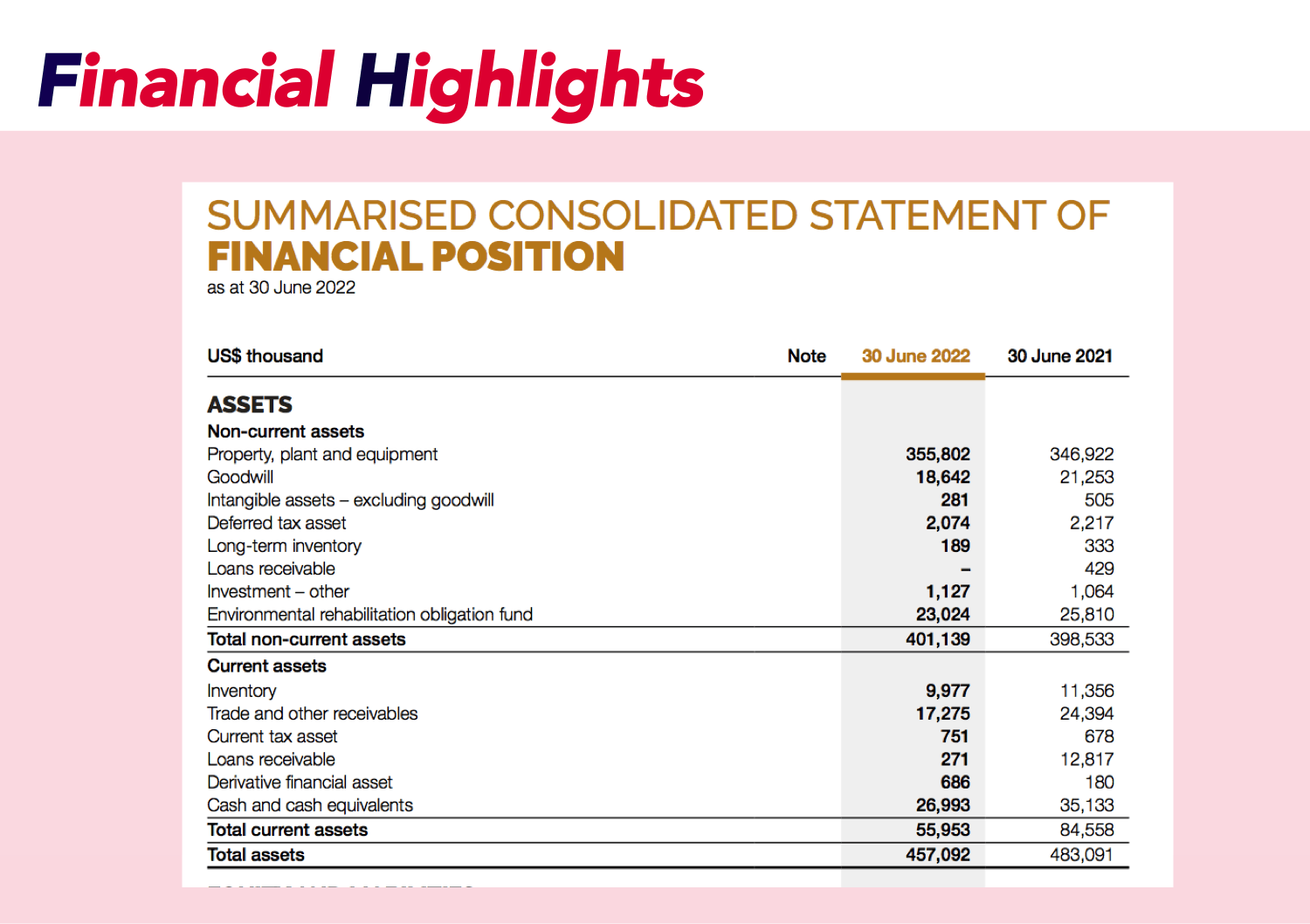

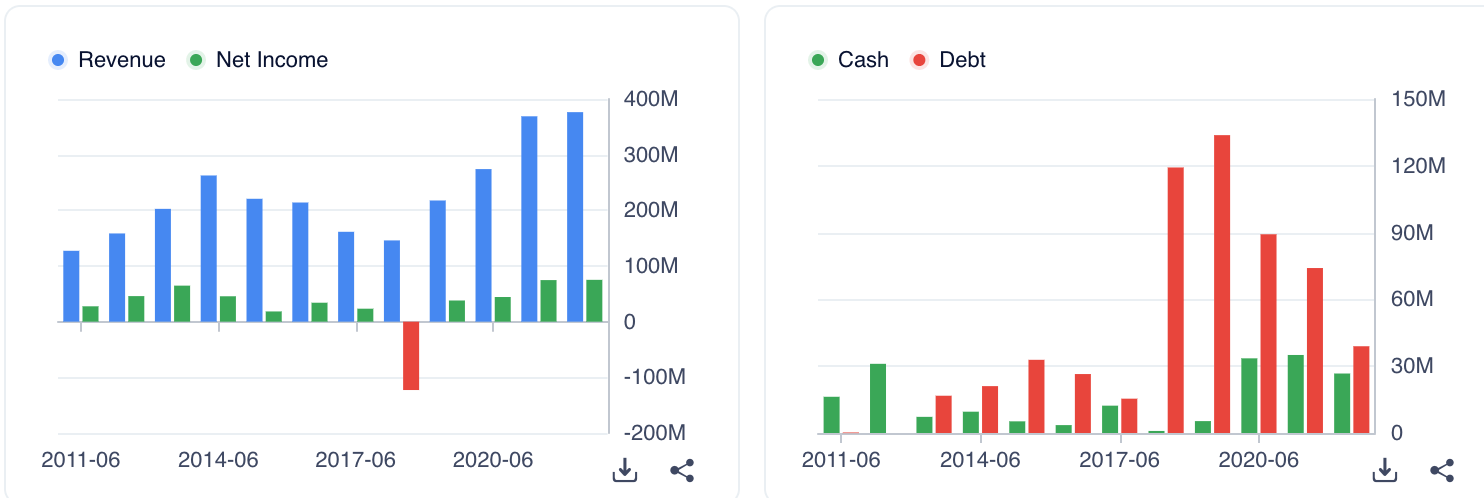

As you can see from the charts above, PAF has rarely been in as

strong a position as it is at the moment, with high income and revenue, strong cash reserves and very low debt.

Conclusion

Gold has historically been a safe haven for investors in times of recession, and PAF is a financially

strong, stable company with a good record of

growth over the last 5 years. It also pays a

healthy dividend

and has a smart strategy of choosing low-cost, high-value mining sites.

In conclusion, PAF fits our criteria of being a strong, undervalued, dividend paying company.

We will be adding it to our portfolio today.

As you can see from the charts above, PAF has rarely been in as

strong a position as it is at the moment, with high income and revenue, strong cash reserves and very low debt.