Bell(way) of the ball

When things get a little tricky internationally, as they are at the moment and as they were when Brexit and COVID first hit the news, the UK market often reacts by

trashing banking and housing stocks like there is no tomorrow. But tomorrow inevitably arrives and often it brings with it an

increased demand for housing.

In the past, we have had

success taking advantage of these

drops in share price by investing in

high-quality housing stocks and waiting for the market to

correct. Because of the volatility in recent times, even well-run, profitable housing stocks frequently become

undervalued, making them a relatively

safe investment when the markets take a downturn. We do already own 2 of these profitable housing companies:

Redrow PLC

and

Kingfisher PLC, but we believe this is a time to be

greedy so have decided to add a third that is looking particularly undervalued this month.

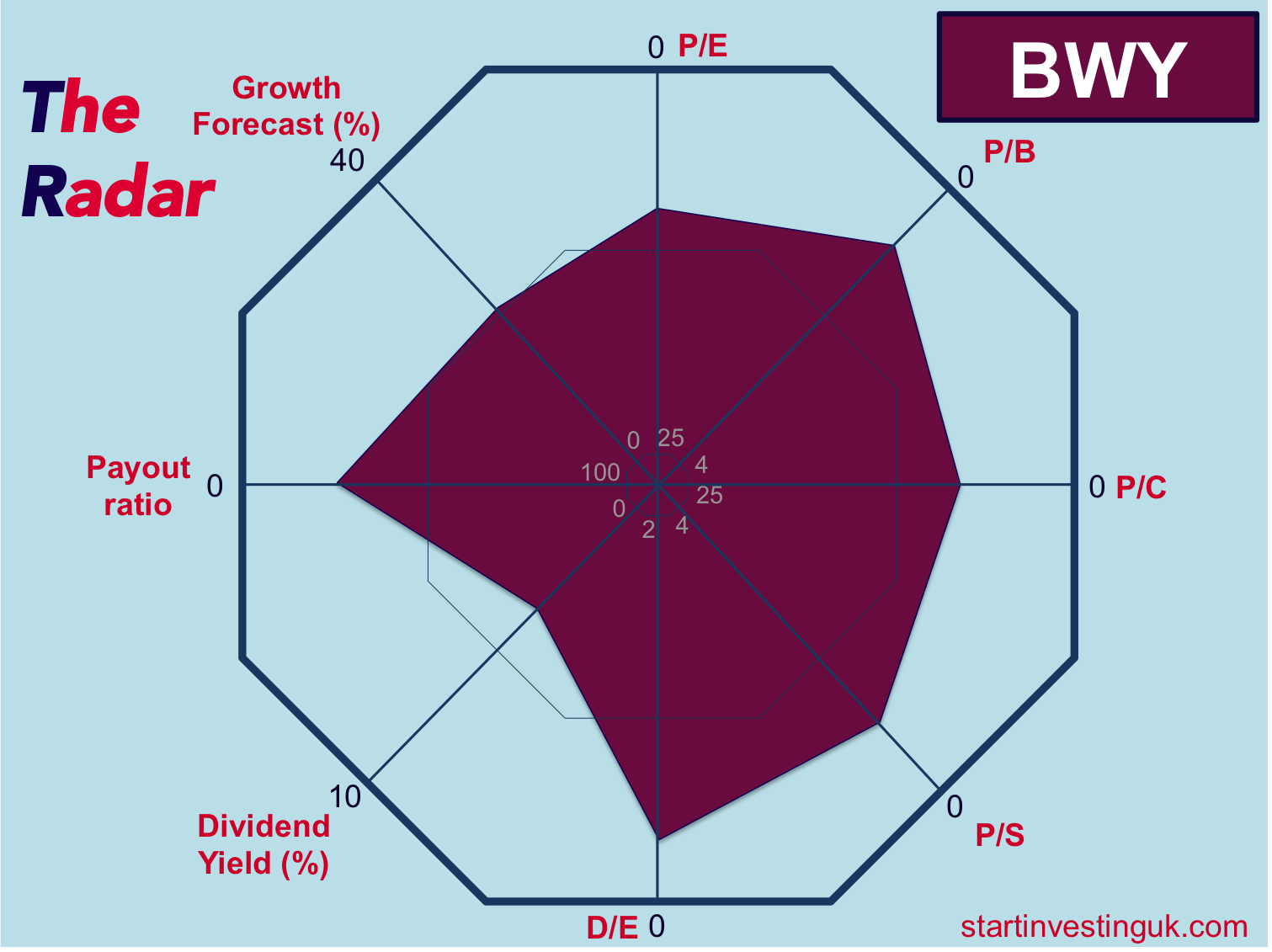

Bellway PLC has had an

excellent 2021, surpassing its performance in 2020 by a

large margin and - relative to their financials - they are now looking

undervalued.

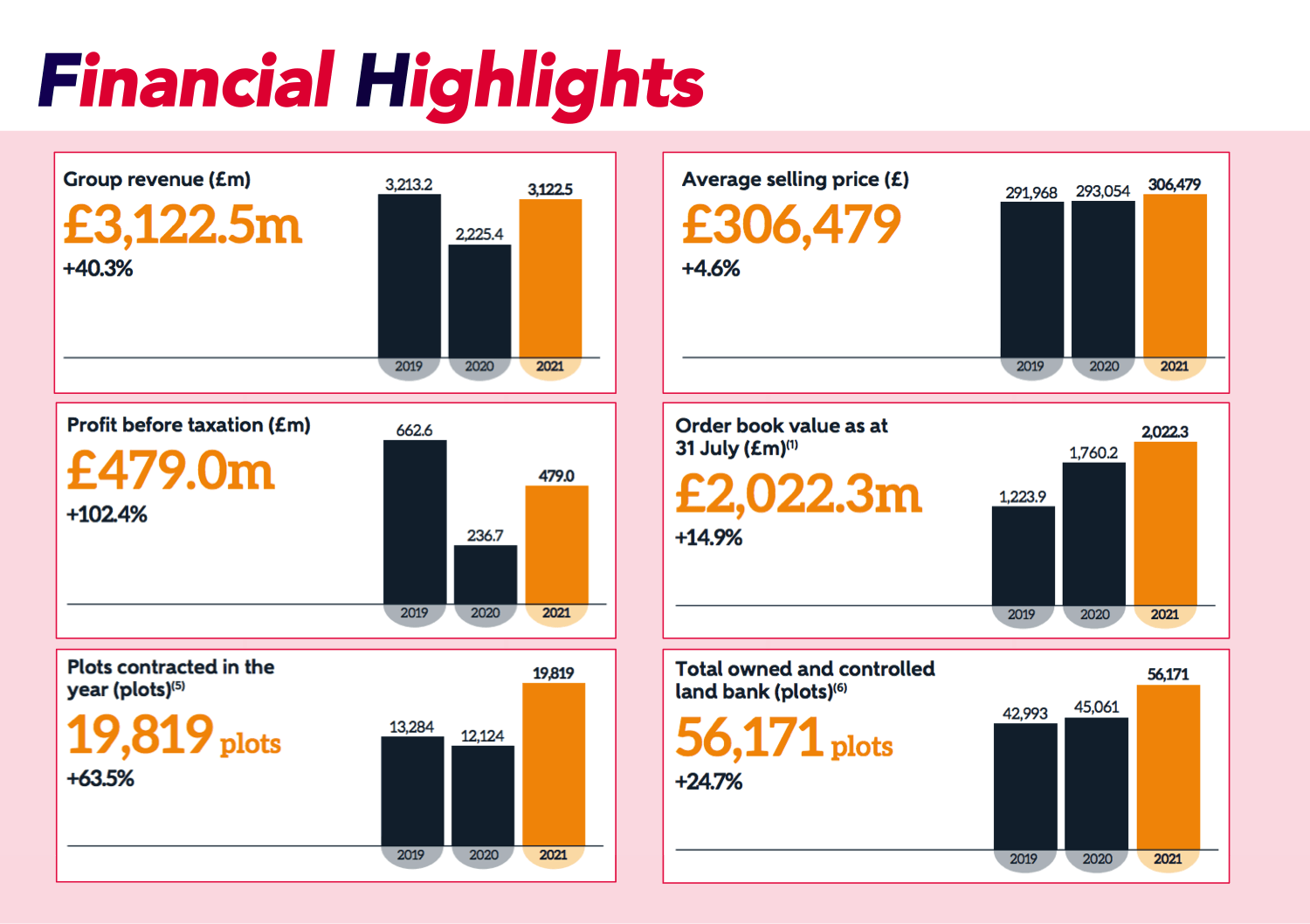

Source: Bellway PLCIn February, the company

reported that they are well on the way to

exceeding their 2021 results and are anticipating

further growth in both 2022 and 2023.

Highlights included: - Strong underlying demand, with a

5.8% increase in the overall reservation rate

- 3.8%

increase in the private reservation rate

- Growth in volume output, a record

5,694 completed homes (2021 – 5,656)

- 2.8% increase in the average selling price to

£311,800 (2021 – £303,206) and is expected to be over £300,000 for the full financial year

- Underlying operating margin for the full financial year increased to

18% (31 July 2021 – 17.0%)

- Strong forward sales position, with an order book comprising

6,628 homes (2021 – 5,889 homes) and a value of

£1,940 million (2021 – £1,625 million).

- Volume growth of around

10% to over

11,100 homes

expected this financial year (31 July 2021 – 10,138 homes) and expected output of around

12,200 homes in financial year 2023

Downsides? - Balance sheet and net cash down to

£196 million (2021 – £346.4 million)

Initially the market reacted

favourably to these results, the share price increasing to above

£30, however that was quickly forgotten about in light of the ongoing conflict in the Ukraine and today the price is back below £28 at the time of writing.

- Strong underlying demand, with a 5.8% increase in the overall reservation rate

- 3.8% increase in the private reservation rate

- Growth in volume output, a record 5,694 completed homes (2021 – 5,656)

- 2.8% increase in the average selling price to £311,800 (2021 – £303,206) and is expected to be over £300,000 for the full financial year

- Underlying operating margin for the full financial year increased to 18% (31 July 2021 – 17.0%)

- Strong forward sales position, with an order book comprising 6,628 homes (2021 – 5,889 homes) and a value of £1,940 million (2021 – £1,625 million).

- Volume growth of around 10% to over 11,100 homes expected this financial year (31 July 2021 – 10,138 homes) and expected output of around 12,200 homes in financial year 2023

- Balance sheet and net cash down to £196 million (2021 – £346.4 million)