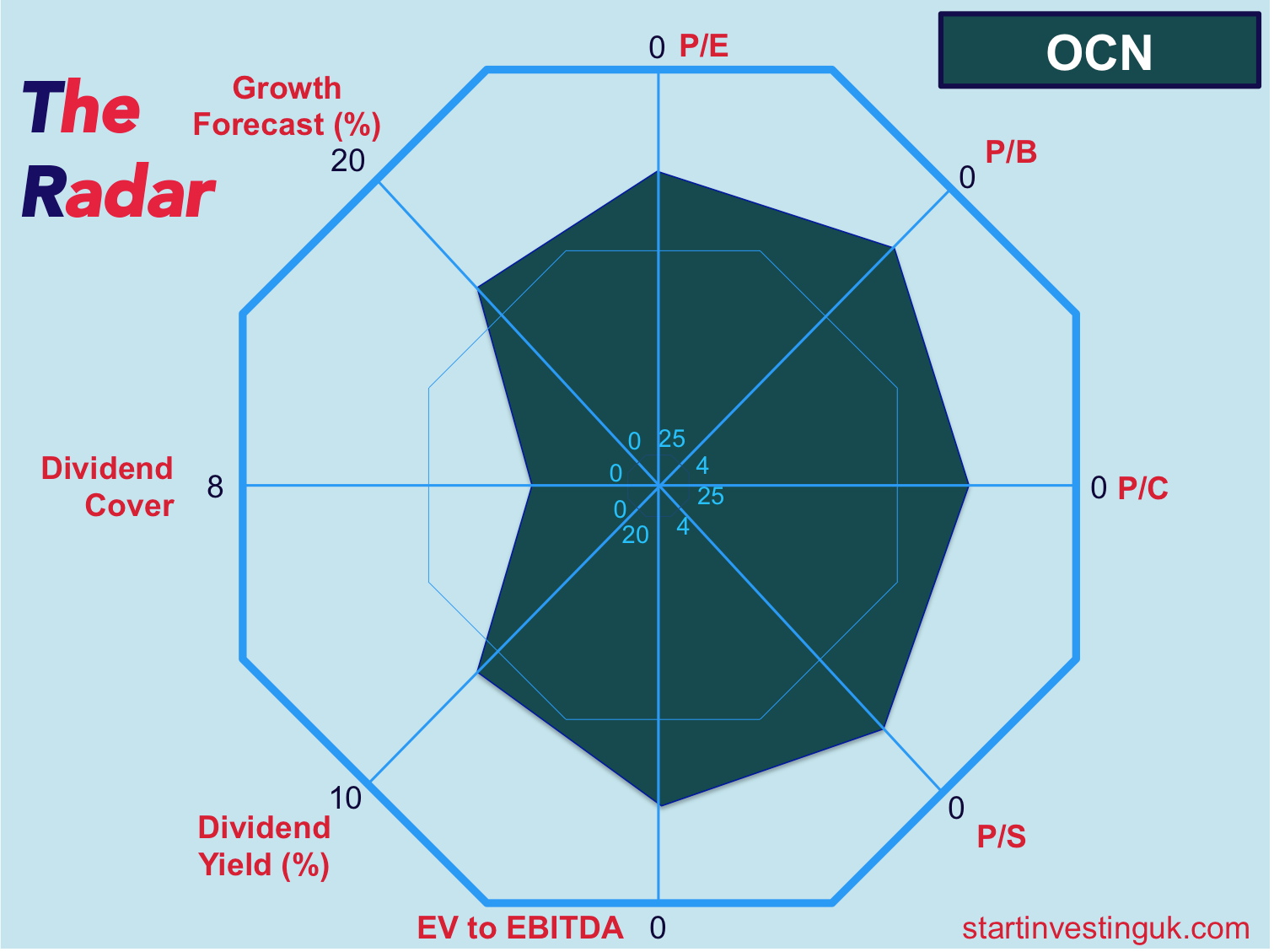

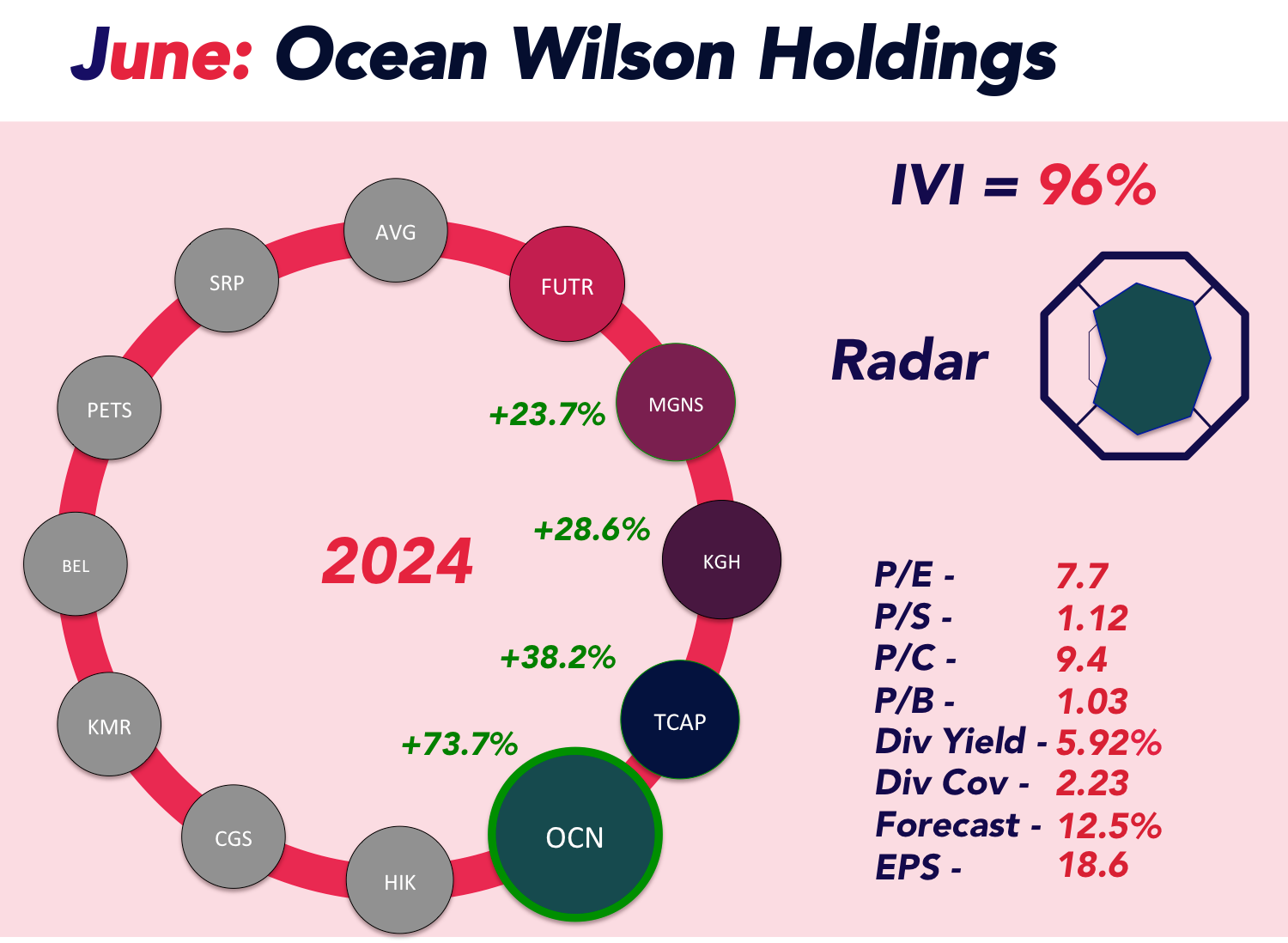

OverviewOcean Wilsons Holdings Limited has demonstrated exceptional resilience and growth in a year marked by global uncertainty and geopolitical turmoil. Here’s why we believe this investment holding company, with its robust maritime services in Brazil and diverse global investment portfolio, is a standout choice for your investment portfolio this month.

Record-Breaking Financial Performance

In 2023, Ocean Wilsons achieved its best financial performance to date. The company's pretax profit soared to $130.7 million from $38.1 million the previous year, driven by significant gains in both its operational and investment segments. This remarkable increase was attributed to the stellar performance of its Brazilian subsidiary, Wilson Sons, which saw unprecedented growth in revenues and profits across all its divisions, including towage, container terminals, and offshore services. The investment portfolio also rebounded strongly, delivering a gross return of 10.1%, far surpassing the benchmark of 6.4%.

Increased Dividends Reflecting Strong Returns

Reflecting its strong financial health, Ocean Wilsons has proposed an annual dividend of 85 cents per share for 2024, up from the 70 cents paid in previous years. This increase underscores the company's commitment to delivering value to its shareholders and is a testament to its solid returns and growth trajectory.

Strategic Review and Market Position

The ongoing strategic review of Wilson Sons’ Brazilian operations indicates a proactive approach to enhancing operational efficiency and market positioning. Despite potential distractions, the management has maintained a laser focus on operational excellence, resulting in an all-time high stock price for Wilson Sons. This strategic review could unlock further value and growth opportunities, positioning the company to capitalize on the more stable global shipping industry in the coming years.

Commitment to ESG and Sustainable Practices

Ocean Wilsons has made significant strides in responsible investing and corporate sustainability. The company’s inclusion in the Corporate Sustainability Index (ISE) of the Brazilian stock exchange highlights its dedication to ESG principles. This recognition not only enhances its reputation but also aligns it with global sustainability benchmarks, making it an attractive investment for those prioritizing ethical and sustainable practices.

Navigating Uncertainty with Strong Fundamentals

While the geopolitical landscape remains unpredictable with ongoing conflicts and upcoming elections in major economies, Ocean Wilsons' robust financial health and strategic foresight provide a buffer against these uncertainties. The company's ability to deliver exceptional results amidst such challenges speaks volumes about its management's expertise and strategic vision. Looking ahead, the firm said it started 2024 in a ‘position of strength’, due to a solid performance in 2023, but said its outlook remained uncertain due to continuing armed conflict in several regions, as well as the upcoming UK and US elections.

Conclusion:Ocean Wilsons Holdings Limited is well-positioned to navigate the turbulent global landscape, offering strong financial returns, strategic growth opportunities, and a commitment to sustainability. These factors make it a compelling investment choice this month. As always, consider your investment goals and risk tolerance, but Ocean Wilsons stands out as a beacon of stability and growth in uncertain times.

| Month | Company | Ticker Symbol | Purchase Date | Current Stock Price (p) | Dividend Yield To Date (%) | Re-Invested (£) | Regular Monthly Investment (£) | Purchase Price (p) | Sold? | Dividend Income (£) | Growth with Dividends | Growth without Dividends |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| February 2023 | Cranswick PLC | CWK | 06/02/23 | 3569.00 | 1.79% | £0.00 | £2,118.78 | 3082.00 | Yes | £37.93 | 17.6% | 15.8% |

| March 2023 | Avingtrans PLC | AVG | 06/03/23 | 387.50 | 1.02% | £0.00 | £2,805.08 | 435.00 | No | £28.71 | -9.9% | -10.9% |

| April 2023 | Vesuvius PLC | VSVS | 03/04/23 | 472.83 | 5.48% | £0.00 | £1,465.86 | 410.00 | Yes | £80.35 | 20.8% | 15.3% |

| May 2023 | Tyman PLC | TYMN | 02/05/23 | 296.00 | 1.73% | £0.00 | £1,212.35 | 249.19 | No | £20.96 | 20.5% | 18.8% |

| June 2023 | PayPoint PLC | PAY | 05/06/23 | 541.75 | 6.67% | £0.00 | £1,460.29 | 407.14 | Yes | £97.42 | 39.7% | 33.1% |

| July 2023 | Pan African Resources PLC | PAF | 03/07/23 | 22.35 | 2.57% | £0.00 | £1,255.45 | 12.88 | No | £32.23 | 76.1% | 73.5% |

| August 2023 | Hikma Pharmaceuticals PLC | HIK | 01/08/23 | 1863.00 | 0.00% | £0.00 | £879.21 | 2089.00 | No | £0.00 | -10.8% | -10.8% |

| September 2023 | Castings PLC | CGS | 04/09/23 | 329.00 | 1.20% | £6,268.97 | £889.28 | 343.63 | No | £86.03 | -3.1% | -4.3% |

| October 2023 | Kenmare Resources PLC | KMR | 02/10/23 | 355.00 | 0.00% | £4,128.93 | £1,086.90 | 416.00 | No | £0.00 | -14.7% | -14.7% |

| November 2023 | Pets at Home PLC | PETS | 06/11/23 | 270.00 | 1.52% | £2,904.50 | £0.00 | 299.00 | No | £44.26 | -8.2% | -9.7% |

| December 2023 | Serco Group PLC | SRP | 04/12/23 | 186.40 | 0.00% | £3,517.95 | £677.78 | 158.76 | No | £0.00 | 17.4% | 17.4% |

| January 2024 | Avingtrans PLC | AVG | 08/01/24 | 387.50 | 0.00% | £0.00 | £2,335.92 | 392.00 | No | £0.00 | -1.1% | -1.1% |

| February 2024 | Future PLC | FUTR | 05/02/24 | 697.00 | 0.00% | £0.00 | £1,494.79 | 716.12 | No | £0.00 | -2.7% | -2.7% |

| March 2024 | Morgan Sindall Group PLC | MGNS | 04/03/24 | 2270.00 | 0.00% | £1,446.59 | £1,045.43 | 2307.43 | No | £0.00 | -1.6% | -1.6% |

This is our portfolio tracking table, which we will update every month on this page.

If you haven't already, you can download the 'smart'

version of this table on which you can fill out and track your own returns, click the button below.

All you need to do is copy the row for this month's pick and paste it into your table. Then enter your own values in the cells:

Amount Re-invested

(which will be 0 for the first year)

Regular Monthly Investment

(the amount you have invested in £)

Purchase Price

(the cost of 1 share of the stock you have bought in pence)

The rest of the table will be taken care of by our

'smart' formulae.

Download Smart Returns Tracker

This is our portfolio tracking table, which we will update every month on this page.

If you haven't already, you can download the 'smart'

version of this table on which you can fill out and track your own returns, click the button below.

All you need to do is copy the row for this month's pick and paste it into your table. Then enter your own values in the cells:

Amount Re-invested

(which will be 0 for the first year)

Regular Monthly Investment

(the amount you have invested in £)

Purchase Price

(the cost of 1 share of the stock you have bought in pence)

The rest of the table will be taken care of by our

'smart' formulae.