Safe as houses

We like

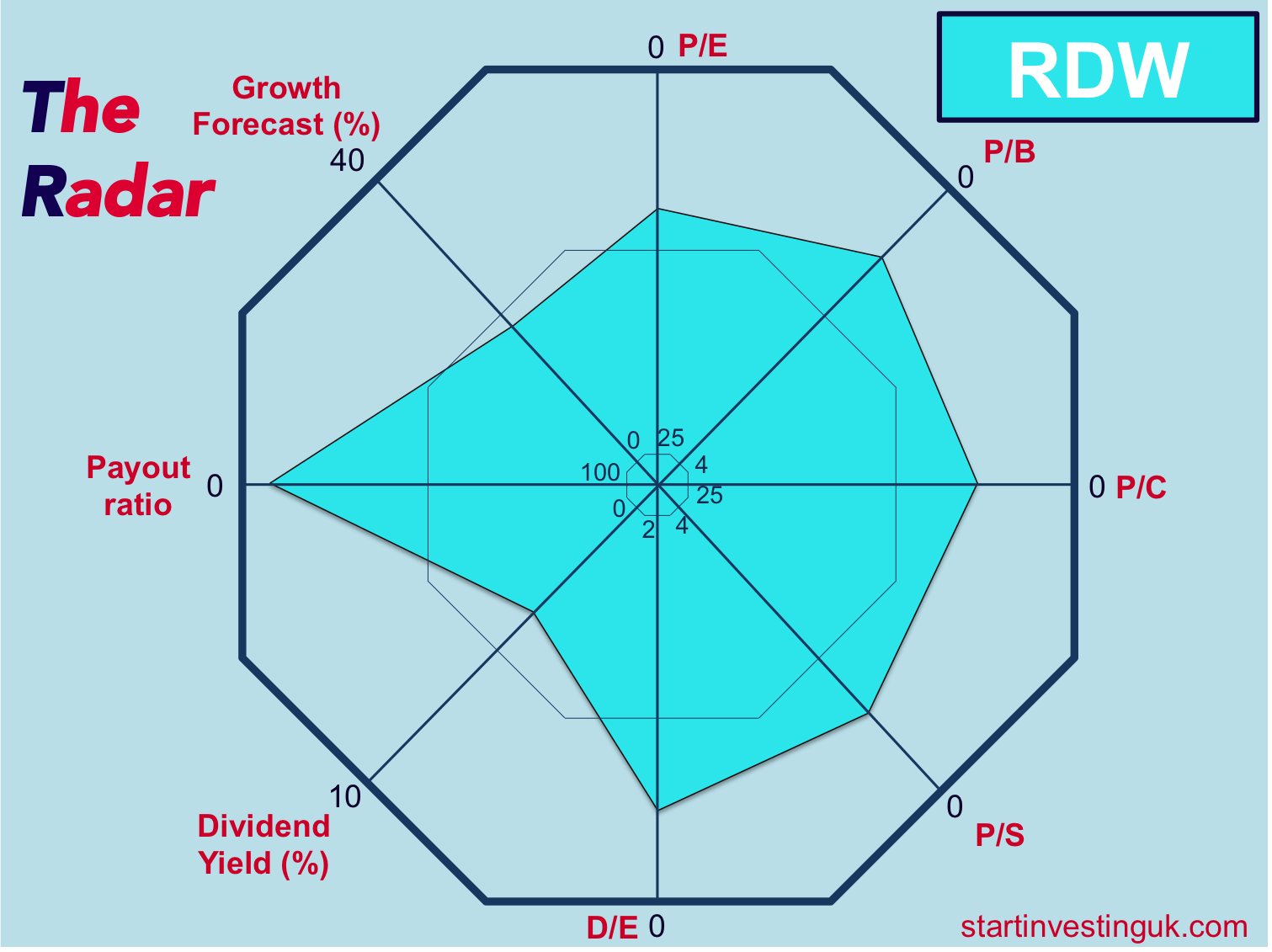

Redrow

for a few reasons. Firstly, its products - houses

and

land - are not in danger of going out of fashion any time soon. In fact, government schemes such as

help-to-buy

and the

stamp duty holiday, have made the housing market

extremely

profitable

in recent times. Secondly, Redrow's most recent annual report (15th September) saw it climb to within 3 places of the

most undervalued stock

in the UK based on our IVI metrics. The fact that it's share price declined about 15% in that time has also contributed to it's excellent performance. Thirdly, and most importantly, we just really like the way the

company is run

because of their focus on the following: - Successful leadership

- Strong and efficient balance sheet

- Quality housing

- Versatile product range

- Expertise in land buying

Music to our ears; combined with a

strong underlying demand

for quality housing in the UK, these core values should add up to a

safe and sustainable

company for the long-term.

RDW may not be a new name for some of you who were with us from the

Start Investing

days, when we originally bought in at around £4.18. Since then Redrow has seen highs of £8.50 in Feb 2020 before plunging to £2.93 during the market crash in March 2020. We have held on to our shares throughout because we see RDW as an excellent

long-term

prospect, collecting and re-investing our dividends along the way. Now the share price is at

£6.48, somewhat under what we feel is fair value given their most recent financial results.

We like Redrow for a few reasons. Firstly, its products - houses and land - are not in danger of going out of fashion any time soon. In fact, government schemes such as help-to-buy and the stamp duty holiday, have made the housing market extremely profitable in recent times. Secondly, Redrow's most recent annual report (15th September) saw it climb to within 3 places of the most undervalued stock in the UK based on our IVI metrics. The fact that it's share price declined about 15% in that time has also contributed to it's excellent performance. Thirdly, and most importantly, we just really like the way the company is run because of their focus on the following:

- Successful leadership

- Strong and efficient balance sheet

- Quality housing

- Versatile product range

- Expertise in land buying

RDW may not be a new name for some of you who were with us from the Start Investing days, when we originally bought in at around £4.18. Since then Redrow has seen highs of £8.50 in Feb 2020 before plunging to £2.93 during the market crash in March 2020. We have held on to our shares throughout because we see RDW as an excellent long-term prospect, collecting and re-investing our dividends along the way. Now the share price is at £6.48, somewhat under what we feel is fair value given their most recent financial results.

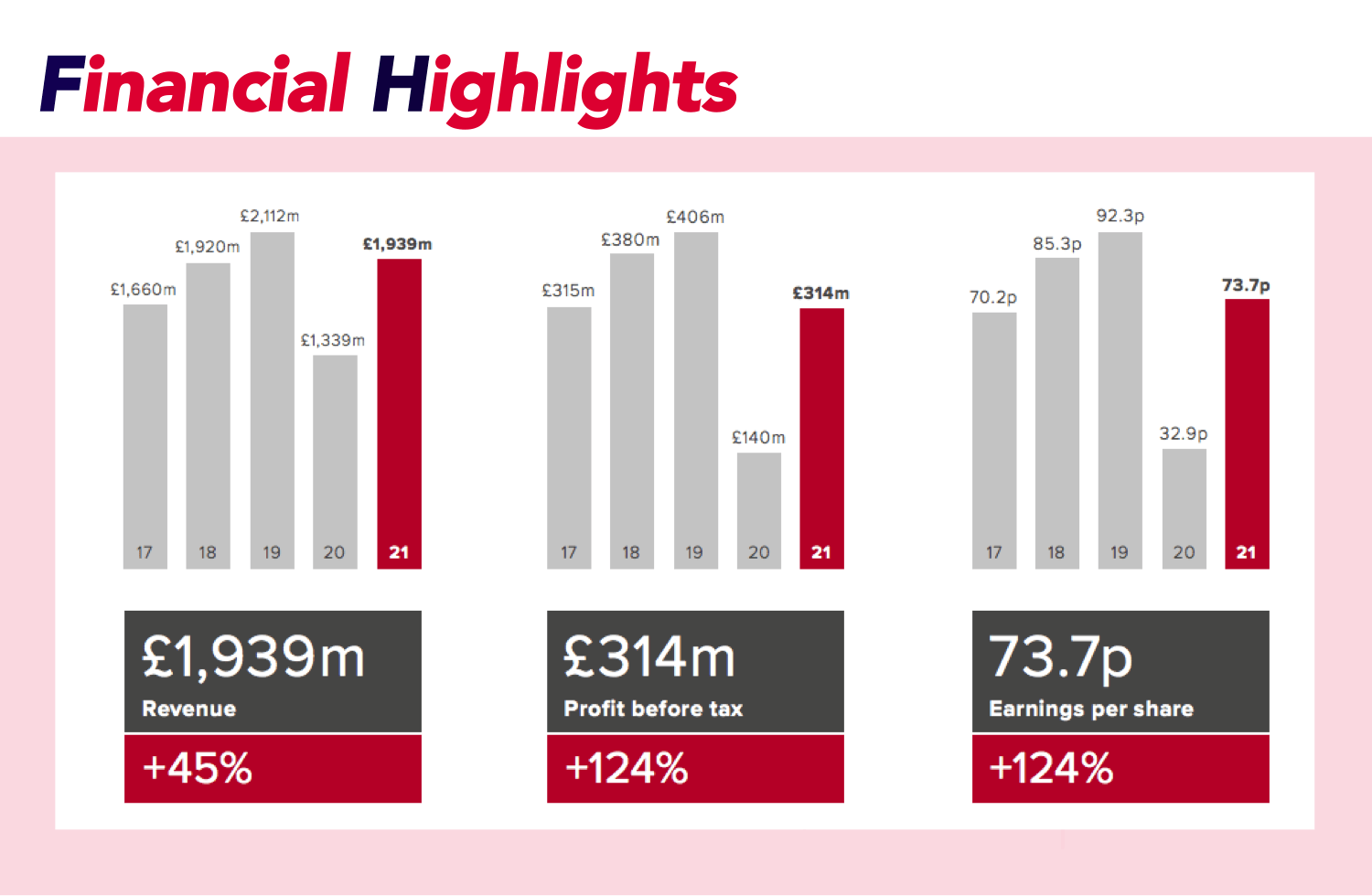

Why is RDW undervalued?

For once, the answer to this question is pretty straightforward! We believe the current share price does not reflect the financial performance because of the

forward-looking statement

in the 2021 annual report

from the Chairman, John Tutte:

"The buoyant housing market has moderated in recent months and we anticipate sales rates will return to historically average rates over the course of the current financial year. It is on this basis we have planned for the future and we are confident our timely investment in land, combined with strong demand for our Heritage homes, will support our longer-term growth aspirations. Additionally, our record order book also provides us with an excellent platform for the future with over £1.3bn of revenue already secured for the current financial year. As a result, the business is well-placed to deliver another set of strong results."

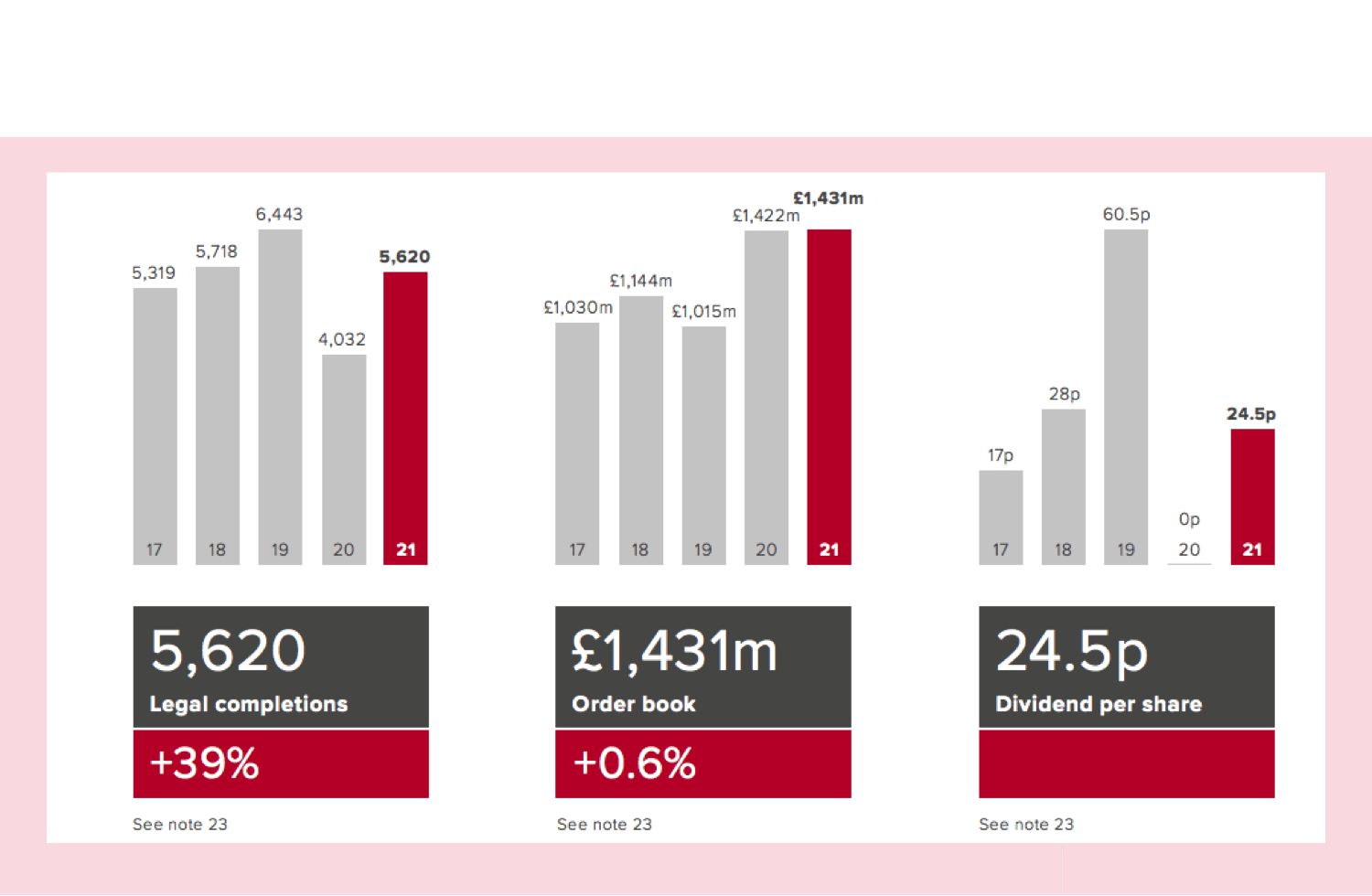

Certainly, the growth in the housing market does seem to be

slowing

in the UK, however future market conditions are always difficult to predict. Unlike the majority of the market, we don't tend to place too much weight on the future

'what ifs', focussing instead on what we

know. What we know is that Redrow has had a

very strong financial year, has a

record order book

for next year and has a long history of providing

sustainable growth

for investors:

“We ended the financial year with another record forward order book of £1.43bn (2020: 1.42bn) of which 73% was exchanged. This provides the business with an excellent foundation for the future with over £1.3bn of our turnover secured for 2022.”

Matthew Pratt, Group Chief Executive

"The buoyant housing market has moderated in recent months and we anticipate sales rates will return to historically average rates over the course of the current financial year. It is on this basis we have planned for the future and we are confident our timely investment in land, combined with strong demand for our Heritage homes, will support our longer-term growth aspirations. Additionally, our record order book also provides us with an excellent platform for the future with over £1.3bn of revenue already secured for the current financial year. As a result, the business is well-placed to deliver another set of strong results."

“We ended the financial year with another record forward order book of £1.43bn (2020: 1.42bn) of which 73% was exchanged. This provides the business with an excellent foundation for the future with over £1.3bn of our turnover secured for 2022.”

Matthew Pratt, Group Chief Executive