'Selecting Shares that Perform' - Three Lessons Learnt from the Financial Times Guide

The Financial Times Guide by Leo Gough and Richard Koch.

These two seasoned investors brought us The 80/20 Principal and The Con Men, here they collaborate to bring us an excellent guide focussed on share selection. This would be an good introductory guide for anyone looking to start investing in individual stocks; it examines different investing strategies and principals, as well as what sort of person you have to be to stick to them.

I have chosen three lessons from the book, there were many more but these made enough of an impression that I will use them in my own strategy moving forward. If you want to read it for yourself, you can buy it here.

Lesson 1. Averaging down.

This was my number one take away from this book and one that will impact my investing strategy directly and in a practical way. Averaging down means adding to your holding of a stock you already have at a lower price than you previously paid for it, to lower the average acquisition price.

Often when we look at stocks that have become undervalued, the share price has been decreasing while the company remains financially strong. For that reason, our picks are frequently bought when the price has been decreasing and sometimes the price will continue to decrease for a period of time after we have bought it. Old Mr Market can take months or even years before it values the share price correctly. We do very thorough research on our picks at Start Investing and we know that the companies we buy are very strong, so if one of the previous month’s picks has decreased in price from when we initially bought in it can be very tempting to load up on more stock at new bargain prices. I have actually done this on a couple of occasions believing that it falls in line with value investing principals

However, this book maintains that the only thing that matters is the state of the company in relation to the current share price; the previous purchase price is irrelevant.

“Markets tend to over-react by pushing a share price up or down more than is justified when there is some important, surprising news. But even if you are sure the company is good and the shares are undervalued you should not start buying more until you are sure the fall has stopped. ”

It is important to remember that the vast majority of traders do not have a value investing mind-set. So if a stock’s price is tumbling, the majority of traders will sell and continue to sell until the stock reaches its bottom, when larger investors will get involved and the price will increase. This book recommends waiting for 3 consecutive days without a drop in share price and at least one day of a rise in share price before buying more . This sounds a little like trying to time the market to me but does make more sense than averaging down.

Most people lose money by averaging down, so hard consideration is needed to make sure you are not throwing away good money after bad.

Lesson 2. The efficient

market hypothesis cannot be right.

I am not a believer in the efficient market hypothesis; a theory based on Eugene Fama’s research in 1970 stating that share prices reflect all relevant information, and thus that it is impossible to beat the market or achieve above-average returns. In fact, value investing depends this theory being untrue, as it would mean that the existence of an undervalued stock would be impossible.

The book has a very reassuring chapter entitled: 'Why the efficient market hypothesis is wrong'. When discussing the 2008 market crash, the author says:

‘What happens to make shares worth 20-70% less in only a few days? In general, nothing very substantial has happened to the underlying businesses. It must therefore be true that either shares were over-valued before the crash, or under-valued after, or both, rather than being correctly valued both before and after.’

Lesson 3. If Warren Buffett was British.

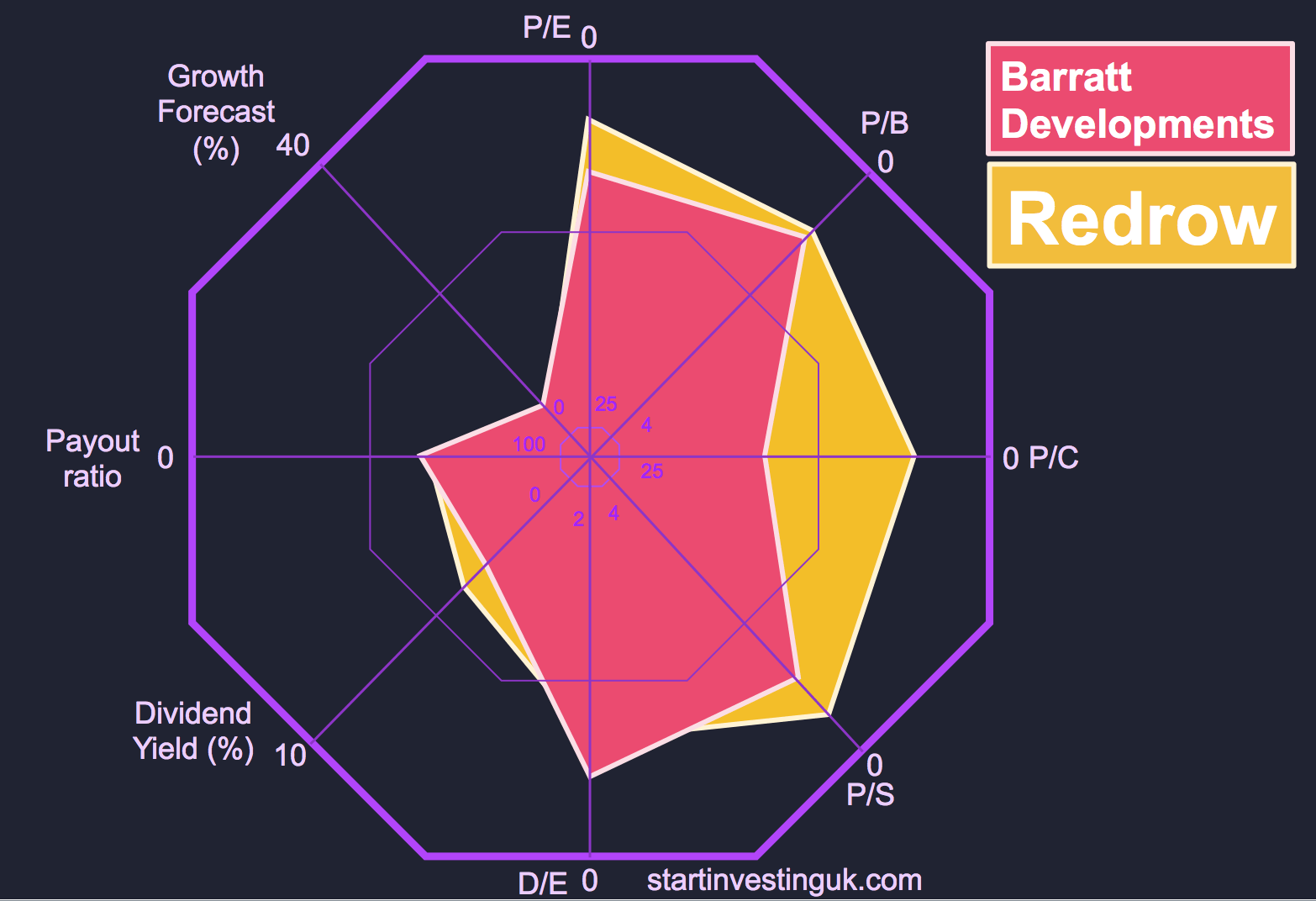

As a value investor, so much is read about the investing greats in the USA and their investing strategies. I find myself looking at UK companies wondering which of them would fit into a Buffett portfolio. This book identifies three good, long term holds from a Buffett perspective:

·Rio Tinto

·Pearson

·Schroders

All three companies possess a wide economic moat, shrewd management and policies that keep shareholder’s interests in mind. I won’t necessarily be purchasing these stocks on this advice alone, but I will certainly keep a close eye on them with a view to buying if they become undervalued.

Overall this was a very helpful guide and will help you identify what type of investor you want to be. If you want more tips like these three you can pick the book up here on Amazon.

Thanks for reading!

Joe