When The Market Is Crashing Around You: Keep Calm - Keep Investing

There are a lot of panicking investors out there; the stock market is crashing and people are selling large parts of their portfolio because they are scared they will lose everything.

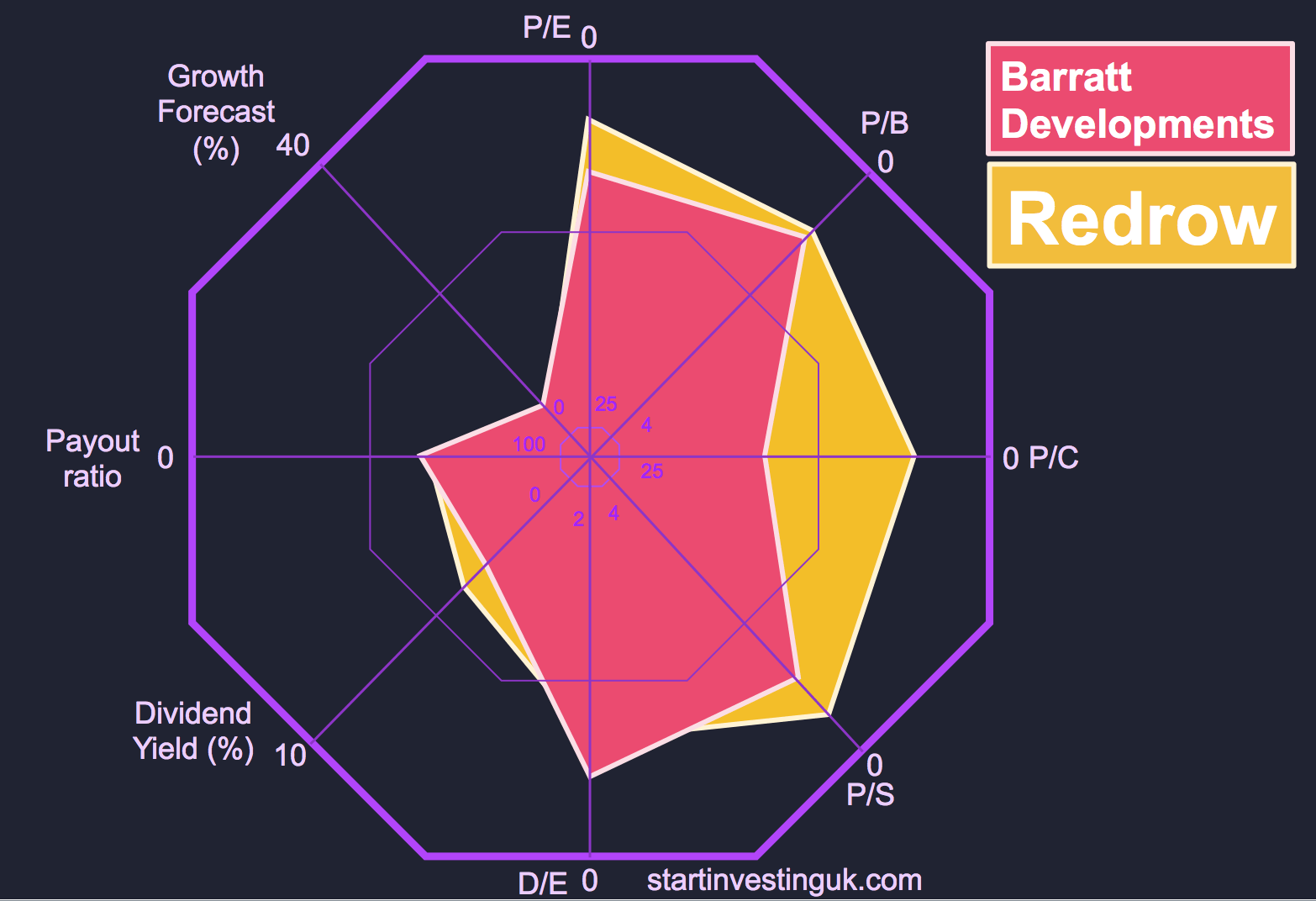

At Start Investing we are not panicking; we know we have invested in strong companies, companies that are equipped to survive recessions and come back stronger, not because they are in-vogue or exciting, but because they are good businesses.

Crucially we have invested in companies that pay a healthy dividend, which is beneficial in this climate. We re-invest those dividends, which means that they are automatically used to buy more shares of the company as soon as they are paid. When the share price of the company drops, more shares are purchased. For example, if you are paid a £10 dividend and the company's share price is £2, directly reinvesting your dividends will mean that you buy 5 more shares of the company (5 shares at £2 each = £10). However, if the company's share price drops to £1, because the dividend payment will remain £10, by reinvesting you will acquire 10 shares (10 shares each at £1 = £10).

Now when the

price increases we will own more shares and our gains will be greater. Even better than that, the next time we are payed a dividend we will own 10 more shares, the payment will be bigger and we will reinvest again! This is how compounding turns a little into a lot. Using dividend re-investment is a great way to profit from market

downturns.

THE LAST THING WE WOULD WANT TO DO NOW IS SELL OUR DIVIDEND PAYING SHARES!

If we think about the market in terms of Ben Graham’s Mr Market (a metaphor for the market represented by a temperamental, erratic salesman whose mood swings can offer great bargains or jumped up prices) the current climate shows him to be in a totally unreasonable mood.

In some cases he is offering to buy shares for less than they were bought for, even though nothing has changed in terms of the company’s strength; not a good deal. However he is also offering to sell some great companies at a discount, companies that have been around for decades with strong financials, wide moats and that pay a healthy dividend.

This is a man you want to be buying from, not selling to.

“You make all your money in a recession; you just don’t know it.”

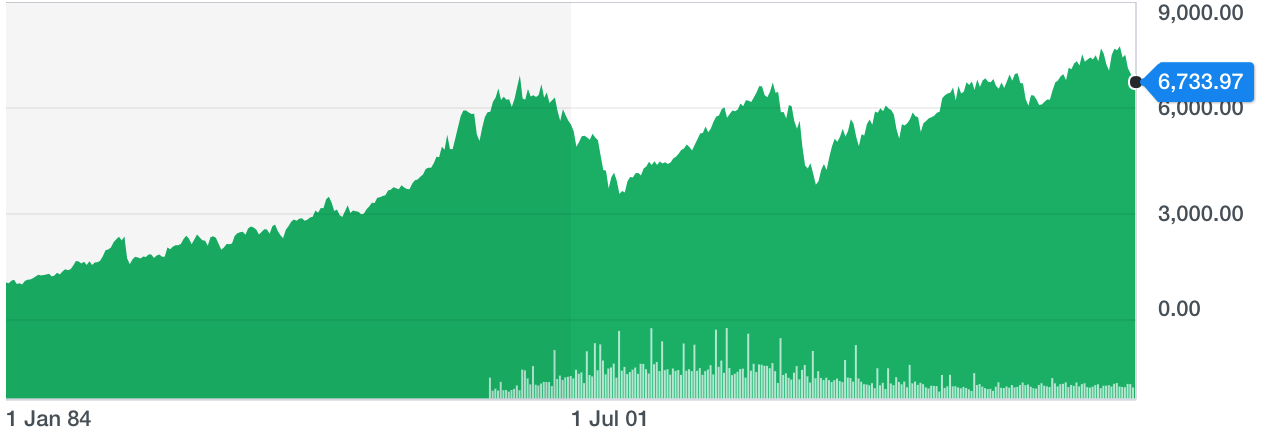

Short term trends in the market are impossible to predict, but they always increase in the long term.

FTSE 100 1984-2018. Source: Yahoo Finance

"How do we know the market won’t keep falling?"

Well, the truth is that no one knows when the market will pick up

again. It could easily drop another 20% in the next few months, it could take

another few years before we see the FTSE back up to the levels we saw at the

beginning of 2018. It could also be a temporary set back which could see a rebound in the next few weeks.

Two things are certain: firstly, anyone who says they know

which way the market is going to go in

the short-term

is either mistaken or dishonest; and secondly, the market will

return to its previous levels

eventually. We have seen time and time again, through great depressions, housing

crises, bubbles and two world wars; the market always

recovers.

A market crash is the time to buy shares. There is a sale on and now is the time that smart investors will take advantage.

What this market downturn should underline to you is the importance of a long-term investing horizon; if you are depending on money that you have invested to pay your bills or for a house deposit; you are going to have a bad time.

In the short-term the stock market is a gamble; you are just as well head to the roulette table and put it all on black, or bet on Manchester United to win the league. Even with the best company in the world or the safest strategy you cannot predict Mr Market’s short-term moods.

What you

can rely on is that the stock market as a whole will increase ON AVERAGE by

6-9% per year. So if you’re in the game for long enough, you will see gains -

as long as the stocks you are picking are of high quality, of course.

At Start Investing we use a strategy called pound cost averaging where we invest the same amount of money into the market every month; this means we keep adding money when the market prices decrease; we do not try and predict what the market will do and we benefit when it recovers.

We always select high quality, dividend paying stocks with a

good potential for growth. We then invest in these companies on the same day

every month in our real money portfolio.

To receive our stock picks sign up to our mailing list here! We send out our picks on the first day of every month, so our next pick will arrive in your inbox on the 1st of the next month.

Merry Christmas and a very happy New Year to all of our current subscribers and a very warm welcome to our new ones!

Joe